Investors who wish to subscribe to Fidelis government bonds can do so until today, at 1:00 p.m., according to information in the offer prospectus of the Ministry of Finance.

The offer is made up of six tranches, four in lei and two in euros, with interest rates ranging between 7.9% and 6.45% for the tranches in the national currency, and 3.75% and 5.75% for those in the European currency.

Until yesterday around 3:00 p.m., for the tranche in lei with a maturity of one year and an interest rate of 6.45%, subscriptions amounted to approximately 471 million lei, while in the case of those with an interest rate of 7.6% and a maturity of five years, the value of purchase orders amounted to 251.6 million lei.

The other two tranches in lei, with maturities of one year and three years, are dedicated to blood donors. The one with maturity in 2025 and interest of 7.45%, had accumulated subscriptions of 142.6 million lei, while for the tranche with maturity in 2027 and annual interest of 7.9%, the value of purchase orders launched by investors was 101.5 million lei. Within these tranches, people who have donated blood starting with July 1, 2024 or who donate during the period of the Fidelis government securities sale offer can subscribe.

The euro tranches have maturities of two and seven years, with annual interest of 3.75% and 5.75%, subscriptions amounting to 63.6 million euros and 100.5 million euros, respectively, by yesterday at 15:00.

The minimum subscription is 1,000 euros for tranches in euros and 5,000 lei for those in lei, respectively 500 lei in the case of blood donors.

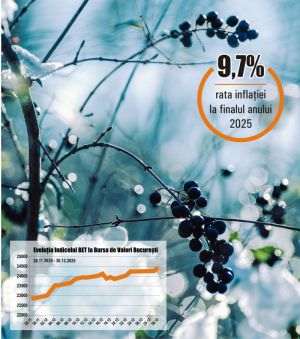

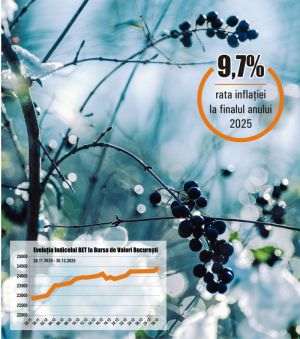

The offer is taking place in a period of high inflation, but which is decelerating. In November, inflation was 5.1%, up from 4.67% in October, but the NBR forecasts 3.5% inflation in the last quarter of next year, which will drop to 3.3% in the third quarter of 2026. In the case of the euro area, the European Central Bank indicates an inflation of 2.2% next year, which will drop to 19% in 1.9% in 2026.

In the process of subscribing to Fidelis government bonds, no commissions are charged by intermediary banks, and the income obtained, both from interest and capital gains, is non-taxable. The bonds will be listed on the Bucharest Stock Exchange on December 27.

So far this year, Finance has raised almost 14 billion lei from the population through five issues of Fidelis government bonds, on top of the 9.4 billion lei in 2023, according to a press release from the Ministry.