Behboud Madadi, a Romanian of Iranian origin, known on the Romanian stock market as Ben Madadi, important shareholder of SIF Muntenia (SIF4), accuses the management of the company of violating some provisions of the European directive concerning the managers of alternative investment funds and the harming of the shareholders of the SIF.

According to his brokerage account, which he runs on his own behalf, Ben Madadi owns 3.92% of SIF Muntenia (the equivalent of 6.3 million Euros at the current price of the SIF4 stock) which probably makes him the biggest individual shareholder of the company.

He also owns two significant blocks of shares of shares in two other SIFs (totaling more than 1.6 million euros at current market prices).

Essentially, the investor presents how the SIF4 leadership directs the company's money towards an investment fund, in which it owns 95% of the fund units and which it pays a management fee to of more than 10% per year, and the fund in question uses the money of the SIF to buy shares in the SIF itself. As a result of the fees charged, the Fund, that is, in fact, the shareholders of SIF Muntenia, is losing money, but the management of the SIF gets the supporting votes of the fund manager, as proven by the material that Ben Madadi sent us, with the mention that it is just an example, and the SIF operates in a similar manner with several such financial vehicles.

"The only difference between the direct purchase as opposed to that done through third-party funds is that their own shares get canceled, so SIF4 investors benefit, whereas in the case of indirect purchase through funds it's only the management of SIF4 that benefits, as it gains the votes of those shares, cast by those funds, in the general shareholder meetings, while SIF4 investors lose: 1) their legal and proportional voting rights; 2) huge and completely unnecessary management fees, every year", says Ben Madadi, who acts on behalf of a group of SIF Muntenia investors.

We mention that before publishing the article, BURSA checked the information submitted by the investor and, essentially, it matches that present in the reports of the SIF, of the mentioned fund, and other public materials. Aside from that, the opinions expressed belong to the investor.

We hereinafter reprint in full the article which the SIF Muntenia investor sent us.

Andrei Iacomi

Indirect ownership of their own shares has allowed the management of SIF4 to no longer need its real shareholders in decision-making

I will present a blatant case of the two investigated, concerning the plundering of a huge patrimony of millions of Romanian investors in three SIFs, which have come to be controlled by a group of people through the violation of several Romanian laws and a European directive. The presentation will be done in two episodes, with this one being the first.

After buying about 4% of SIF Muntenia (SIF4), I posted a public message on Facebook, in which I stated that the practice of a company holding its own shares, indirectly, via independent funds, is anti-constitutional (it violates ownership and the shareholders' voting rights) and causes losses to SIF4 shareholders/investors.

Hereinafter, I will demonstrate the first case of flawed management and in bad faith of the SIF4 patrimony by the company's leadership, which is directly related to the practice of indirect ownership of the own shares of the SIF through third-party funds. The evidence comes from information gathered from documents accessible to anyone. But what other cases, probably more serious, may exist? Because most cases related to these funds are not public, we do not know the details.

The situation I will mention exists due to the fact that the practice of indirectly holding its own shares has allowed the management of SIF4 not to apply administrative diligence because, in principle, it does not need the support of its real shareholders in its decision-making.

According to the latest quarterly report of 2020, SIF4 owns 95% of the Active Dinamic fund (i.e. virtually all of the fund's money).

=» Poza 1

This fund has a management fee of 12.5% per year. Which explains why SIF4 is the only investor in this fund. It seems shocking, but you read correctly, the management fee is OVER 1% PER MONTH (not per year, but per month). According to the last quarterly report of SIF4, the company had invested about 15 million lei in that "wonderful" fund, which charges a 12.5% fee per year to give you the honor of depositing your money with them. The manager of that fund is not to blame for charging 12.5% per annum. However, the management of SIF4 is deeply guilty of improper management of the company's funds, deliberately causing losses to shareholders, myself included. This absolutely outrageous fee for SIF4 shareholders means an expense of 1,875,000 lei per year. If this financial vehicle, Active Dinamic had an extraordinary performance, it would probably justify a 12.5% management fee.

=» Poza 2

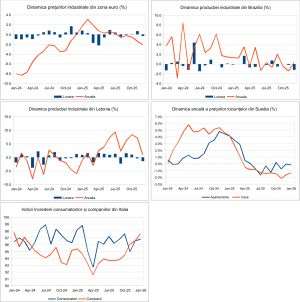

But let's see the performance of this fund of which SIF4 owns over 95%, over the last ten years:

2011: -32%

2012: down several percent

2013: down about ten percent

2014: 2.6%

2015: 0.7%

2016: -12.1%

2017: 2.5%

2018: -14.9%

2019: 13.6%

2020: 6.5%

=» Poza 3

And yet, the management of SIF4, meaning SAI Muntenia which is owned and controlled by SIF Banat-Crişana (SIF1), has continued to keep huge amounts in this fund which is unprofitable for the shareholders the patrimony of SIF4.

That is, in the last 10 years, the Active Dinamic fund has a total yield of - 60%. The main reason for this disastrous yield is the management fee.

According to the latest report, the Active Dinamic fund, had also bought SIF4 shares using SIF4 money. Perhaps the management of SIF4 can show us if Active Dinamic, or its manager through other funds, voted in favor of the wishes of the management of SIF4 in the general shareholder meetings. Voting would be the normal thing to do. But the conflict of interest is absolutely huge! I repeat, it's not the fault of the fund managers. They are companies which want to make profit. And yet the SIF4 leadership, i.e. SAI Muntenia which is held and controlled by SIF Banat-Crişana (SIF1), continued to maintain huge amounts of money in this compensation fund for the shareholders / heritage SIF4.

I am not familiar with every management fee that other funds which SIF4 has invested in charge. But one thing is clear - in the general shareholder meetings of SIF Muntenia, many of these funds are present and vote along with the management of SIF4, with SIF4 shares bought, at least partially, using money they received from SIF4.

Isn't there a conflict of interest between the management of SIF4 and administrators of these funds? Normal that there is.

These funds receive money from SIF4 (and SIF1), they get paid management fees, so it is obvious that they have reason to vote in support of the decisions made by SIF4, as some of their shares are also bought using money received from SIF1 and SIF4, to keep collecting management fees every year, for hundreds of millions of lei.

According to the latest SIF4 report, the management of the SIF had invested nearly 178,500,000 lei (according to the latest evaluation) in all kinds of funds, each more ridiculous than the next.

Fund managers are not willing to take the risk, and have the right not to, of voting against the current management of SIF1 and SIF4, because if someone else came in their place, and began managing the two SIFs with the interest of their investors in mind, they would stop holding hundreds of millions of lei in these unprofitable funds.

What possible usefulness could these funds have for the real shareholders / investors of SIF4? None! If SIF4 wants to hold shares in other SIFs, there is no impediment, so it could own them directly. If SIF4 wants to buy its own shares, it has no reason to do so through investment funds and pay them huge management fees. It can buy them back directly and legally from the market. The only difference between the direct purchase as opposed to that done through third-party funds is that their own shares get canceled, so SIF4 investors benefit, whereas in the case of indirect purchase through funds it's only the management of SIF4 that benefits, as it gains the votes of those shares, cast by those funds, in the general shareholder meetings, while SIF4 investors lose: 1) their legal and proportional voting rights; 2) huge and completely unnecessary management fees, every year.

Directive 2011/61 / EU of the European Parliament and of the Council, of 8 June 2011, on alternative investment fund managers, and amendments to Directives 2003/41 / EC and 2009/65 / EC, stipulate that:

Member States shall ensure that AIFM (Alternative Investment Fund Managers) constantly comply with the following provisions:

a) act with honesty, competence, care, diligence and fairness when conducting their business;

b) act in the interests of the AIF (alternative investment fund) or the AIF investors it manages and of preserving market integrity;

c) own and efficiently use the resources and the procedures necessary for the smooth running of their activities;

d) take all reasonable measures to avoid conflicts of interest and, if they cannot be avoided, in order to identify, manage and monitor and, where appropriate, make the conflicts of interest public in order to prevent them from negatively affecting the interests of the AIF and their investors and to guarantee that the AIF that they manage is treated fairly;

e) comply with all regulations applicable to their activities, so as to promote the interest of the AIF investors they manage and the integrity of the market;

f) treat all AIF investors fairly.

In Romania, SIF4 and other SIFs are considered AIFs, i.e. alternative investment funds. The management of SIF4 (i.e. essentially the SIF1 management through SAI Muntenia) violates all the letters of this European directive, by:

a) acting with blatant carelessness and incompetence;

b) acting against the interest of the AIF, otherwise it would not show such lack of interest in the funds of SIF4;

c) using SIF4 resources ineffectively, giving them all to all sorts of investment funds that do not create value for SIF4 shareholders, but on the contrary, generate losses for them;

d) doing everything in its power, not to avoid conflicts of interest, but on the contrary, makes every effort to maintain conflicts of interest with the managers of these funds which are unprofitable for SIF4 shareholders;

e) promoting not the interest of the AIF (SIF4) or AIF investors, but the preservation of its leadership position at SIF4, undermining the rights of SIF4 shareholders;

f) not treating all SIF4 investors fairly because SIF1, with 5% of capital, directly and indirectly, with SIF4 money, actually, controls over 25% of the voting rights of SIF4.

It is astonishing how people who have seized three SIFs with assets that together have assets worth 1.3 billion Euros have managed, for years to openly infringe on a European directive and cause losses to millions of people, most of them Romanian small investors. I am convinced that the authorities will take action and the above-mentioned practices will end. The Romanian capital market must go through a much delayed cleanup, and investors' rights must be taken seriously. Otherwise, the Romanian stock market will continue to remain insignificant and unproductive for the economy.