Nokia"s decision to end its operations in Romania surprised many Romanians, just like, at the time, the decision of Nokia to relocate its operations from Germany to Romania sparked the protests of the Germans.

Throughout the public debates, one question kept popping up: what other foreign investors are going to leave Romania? Most of the times, the answers to that question were emotional.

I think we can provide an adequate answer, if we review the nature of the competitive advantage we can provide which anyone who has to make a decision on investing in Romania must take into account. To the extent to which we succeed in identifying this competitive advantage, we can then draw conclusions on its durability over time, and, inherently, on what could cause foreign investors to come to Romania and to leave.

The starting point is the structure of the volume of foreign investments made in Romania at the end of 2009, which amounted to 50 billion Euros, (NBR, Report concerning direct foreign investments, in 2009).

A first group of foreign investments was focused on the domestic Romanian market. The most familiar examples are those in the retail industry - Metro, Billa, Carrefour and others - investments of 6.2 billion Euros (12.3% of the total volume of foreign investments at the end of 2009) and in the banking and financial sector - Erste, Societe Generale, Raiffeisen, Unicredit, Allianz etc - investments of 9.5 billion Euros (19.0% of the total).

Investments in this group are here to stay. Their goal is to turn out a profit from the services they provide on the Romanian local market. Leaving the country would mean the loss of the consumers from this market.

Investors in that group don"t stop their activity when constraints appear. For instance, in Hungary, throughout the crisis, the government has imposed an additional tax on multinational companies operating in the aforementioned sector to avoid having to severely cut pensions and salaries in the public sector.

The departure of a foreign investor could occur for instance, through the bankruptcy of the main shareholder (for instance the parent bank located abroad), or because of competition on the domestic market.

A second group of foreign investments is focused on making profits from exploiting Romania"s natural resources.

This is where we find, for the most part, foreign investments in the cement, glassware and ceramic industry -1.6 billion Euros (3.3% of the total), of the mining industries, oil processing, chemical products, rubber and plastics, electricity, natural gas and water -8.2 billion Euros (16.6% of the total), of the wood industry -1 billion Euros (1.9% of the total).

Investments in this group are resilient as well. They can leave after the natural resources have been depleted, when they go bankrupt because of competition, or, for instance, when Romania will no longer be willing to have one of its mountains disappear from its natural landscape, regardless of what benefits it may draw from that happening.

Also, we can include in this group foreign investments in agriculture, forestry and fishing - 0.5 billion Euros (1.1% of the total).

The third group of foreign investments is the area of industries which require major investments in equipment and tools and which process imported raw materials, such as metallurgy for instance -2.6 billion Euros (5.2% of the total) and the rest of the refineries, others than those which process domestic crude.

In the case of these foreign investments, the mobility of capital sunk into technological equipment is extremely low. As a result, fluctuations in the price of commodities, the costs of maritime and railway shipment, economic cycles and competition affect the rate of usage of the production capacities (for instance, the metallurgic plant of Galaţi).

The ability to relocate these foreign investments is very low, and if activity ends, the partial recovery of the capital is usually achieved by scrapping the equipment and tools and selling the land.

The fourth investment group has sought to exploit the competitive advantage provided by the low labor cost in Romania, with a medium skill level. Examples of foreign investments in this sector include the textile industry, clothing and leather processing, electrotechnic and electronic industry, transportation industry, information processing.

The risk of such foreign investors leaving Romania is high. The competitive advantage based on the low cost of labor can be replicated in another country, where there the s an even lower cost of labor.

This risk becomes even greater in the presence of certain factors. Thus, when the market where the products are sold is remote, it becomes inefficient to bring components to Romania, to assemble them here and to transport the resulting products back across long distances, to the markets on which they will be sold (the Nokia case). Also, the quick reallocation of this kind of investments is helped by the high mobility of capital, because the equipment and tools used can be disassembled and assembled back in a different location very easily.

The fifth group of foreign investments exploits highly skilled Romanian workforce, which has however a relatively low cost, compared to that in developed countries. We are talking here about medical services, software programming, education and others.

These investments are also resistant, because Romania"s real economic convergence with the developed countries is a lengthy process, and the competitive advantage of highly skilled workforce is much harder to replicate.

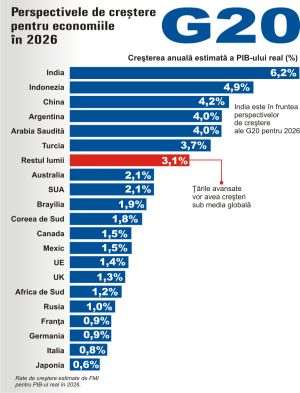

Countries compete with each other to attract foreign investments for the purpose of accelerating their development and raising the living standards of their citizens. For this purpose, governments are doing their best to create a business environment favorable to investors. Governments can also provide certain facilities to investors, while complying, in the case of EU countries, with the norms for preventing anti-competitive practices.

Since in Romania we can only provide investors with a limited number of facilities, it is necessary to establish priorities. For that we need criteria.

From the point of view of economic strength, we are in the upper echelon of the developing countries group, with a gross GDP of USD 7,538 per capita in 2010 (in the same year, Greece had a GDP of USD 26,934 dollars - source: the World Bank).

We are in the area where economic studies show that there is a risk of entering the average income trap; that is, getting stuck and failing to break into the ranks of economically developed countries. The successful vehicle manufactured in Romania and sold in several countries is a product typical for the current level of income existing in Romania. If we are going to limit ourselves to this type of product, we will never get to an average monthly wage of more than 1,000 Euros. In order to go above that income, we need products and services that contain a higher added value.

That is why the first criterion in supporting an investment is the high level of added value for the products or services it will develop.

Romania is a relatively small economy. Raising the living standard depends on the efficient participation in the international economic circuits. Therefore, the development of the productive capabilities for export should be the second criterion used in setting the priorities when it comes to supporting investments.

Of course, we need any investment that creates jobs in the country. But moving Romania among developed countries will depend on how much these investments will meet the aforementioned requirements.