The first draft bill requires companies exploiting natural resources and markets, other than natural gas, to pay a special tax of 0.5%, which will be applied to the income taken into account for calculating turnover. If approved, this fee will be valid between February 2013 to December 2014, in accordance with the fees and rates will be revised starting with the 2014-2015 period, and the Government is seeking solutions to keeping the budget deficit within the limits agreed with the IMF.

Constantin Tampiza, former advisor to the president of Lukoil on the Romanian projects and oil market consultant, considers that the methodology for calculating this tax is wrong.

He said: "Since companies can sometimes have revenues, but no profits and, at the same time, they have major investments to make, such a revenue tax would be an additional tax burden, which will worsen the investment climate in the extraction sector. If you're going to levy a new tax, tax the profits. There are oil companies that don't even recoup their money spent on investments, and if the new taxes get implemented, they will create a negative image for the potential investors".

The activities concerned by this tax include woodcutting, the extraction of superior and inferior coal, of crude oil, of ferrous, uranium and thorium ores, of other metallic ores as well as other mining activities.

According to the draft of the Ordinance, if the company records a profit this fee represents a deductible expense when calculating the taxable profit, being filed and paid on a monthly basis, until the 25th of the next month.

The oil and natural gas producers currently pay royalties amounting to 3.5% and 13.5% of the output, depending on the types of hydrocarbons deposits. These royalty rates were set in 2004 and will remain valid until December 2014.

• Natural energy monopolies will be charged

The State wants to tax natural monopolies in the energy sector, namely the activities for the transport and distribution of natural gas and electricity. For that purpose, a system for taxing the revenues of Transelectrica, Transgaz and all operators in the electricity and gas distribution (companies which are part of the Enel, E.ON, GDF Suez, Electric and CEZ) has been devised.

According to the draft Emergency Ordinance drawn up by the Ministry of Finance, the amount of this tax is 0.45 lei/MWh and is applicable to electricity and gas transported by companies operating on that segment.

A tax of 1.25 lei/MWh is proposed in the case of the electricity and gas distributed by companies specializing in those sectors.

In the cases where the electricity or natural gas is charged to a consumer connected directly to the transport system, the amount of the tax on the natural monopolies will be 1.7 lei/MWh. The same applies to consumers who pay tariffs for services for the distribution of electricity and natural gas exclusively.

The tax on natural monopolies in the energy sector will apply between February 1st, 2013 and December 31st, 2014. By levying this tax, the Government estimates it will raise additional funds for the budget of approximately 257,524,440 lei this year, and an additional 295,708,319 lei, over the course of next year.

According to Government sources, carriers and vendors of electricity and natural gas will most likely recoup these taxes from consumers, in the period ahead. The taxes will cover the deficit of the state budget, rather than go to a fund for helping people who are unable to pay their utility bills, as expected.

• Taxes on the additional revenues from the hike of the gas prices

The Ministry of Finance also wants to tax the additional revenues in the natural gas sector. The draft emergency ordinance also stipulates that the fee on the additional revenues from the sale of natural gas will have to be paid by the companies which combine extraction and trading of natural gas in Romania. The taxation rate is 60% of the taxable base, which consists of the additional revenues which the company gets from the sale of the natural gas, as a result of the liberalization of the national market. Out of the taxable base will be subtracted the royalties pertaining to the additional revenues in question, as well as the investments in the upstream segment, but without exceeding 30% of the additional revenues.

Nicolae Havrileţ, the president of the ANRE (the regulator of the energy market), said: "The need to impose these taxes came as a result of the talks concerning the schedule of the liberalization of the natural gas and electricity markets. Then he discussed the price hikes borne by consumers and the additional revenues which the companies will make from the price hikes alone. These taxes have emerged as a solution for the state to clawback a portion of those revenues obtained thanks to the market circumstances, without any effort of companies in the field. These fees are not imposed by the ANRE."

"In the context of the global economic crisis and the continuous rise of the prices of fuel on the international markets, the energy sector has recorded a substantial increase in natural gas prices, along with the drop in consumers' purchasing power, which had a negative multiplier effect on the economy, a fact which requires measures to make this dysfunction at the level of the consumers of natural gas gradually bearable. At the same time, it is found that the economic operators carrying out combined activities of extraction and sale of natural gas, get additional revenue from the sale thereof, as a result of the deregulation of natural gas prices, without incurring any additional expenses resulting from the activities which generate these additional revenues. In other words, there is an obvious imbalance between the income of operators engaged in the extraction and marketing of natural gas and the costs that they incur, as part of these revenues are derived from causes independent of them, is not a direct effect of their activities", the document states.

Liviu Voinea, the Budget delegate minister, last year said that producers of natural gas and electricity will see higher taxes in 2013, levied on their additional revenues resulting from price liberalization, until the price liberalization process concludes.

The Government has agreed with the representatives of the International Monetary Fund (IMF) and the European Commission (EC) on a liberalization of natural gas prices, by gradually abandoning the regulated tariffs. Prices should be completely deregulated starting in 2013 and until 2018, but according to the regulatory authority (ANRE), the deadline could be extended until 2019.

The data announced last summer by the ANRE show that the price of gas for the population will increase by 10 percent in 2013 and 2014, and in 2015-2018 it will climb 12% a year, through quarterly adjustments, in accordance with the timetable for the elimination of the regulated tariffs.

• Hajdinjak, E.ON: "We were not consulted when it comes to these taxes"

Representatives of private companies argue that they have not been consulted by members of the Government regarding the new tax measures that the Ministry of Finance intends to approve.

Frank Hajdinjak, CEO of E.ON, said yesterday, after the meeting which the representatives of the Utility Companies Association (ACUE) have had with the delegation of the International Monetary Fund, that he knew nothing about these projects, which were handed over "ten minutes before meeting with the IMF." He noted that he was unable to conduct an impact analysis, adding, however, that if distributors will be affected as well, any potential investments they would make would be affected as well. The head of E.ON said that for the time being, he believes that these taxes would not be reflected in the price, noting, however, that he is making this consideration after only reading through the drafts once.

Analyst Aurelian Dochia says that if these measures have not been discussed with the companies, the impact could be quite significant.

"The first impact will be on companies in the field and, later, these increases might be reflected in the bills paid by consumers. Companies have quite large investments to make and if they don't have the money they won't be able to make them. It wasn't exactly unexpected that we would get to see tax hikes, but they came too fast, in my opinion. I was expecting such taxes to happen next year", Mr. Dochia said.

Cristian Pârvan, Secretary general of The Businesspeople Association of Romania (AOAR), believes, however, that "additional taxation on non-renewable resources is correct."

He told us: "It's an older proposal of ours, which we have been pushing for years. There will be several price hikes, in companies which generate profits, which are not the result of their activity. In this case, they should be taxed, so the state can get some of that money as well. The problem is how much the business environment and, ultimately, consumers can bear these taxes. We have to take into account the fact that up until now, the State would get nothing out of those price increases. It's just that these taxes were announced too quickly, we'll see what will happen along the way".

Cristian Pârvan told us that the earnings from the new fees and taxes will go to the state budget in order to ensure a balance between revenues and expenses.

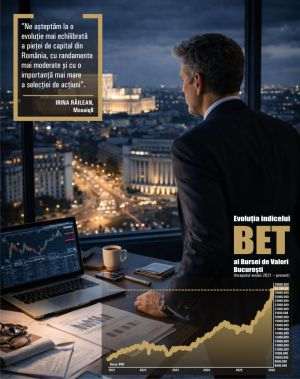

• Brokers: The new taxes will not significantly affect the evolution of the shares of Transelectrica and Transgaz

Transelectrica and Transgaz are companies listed on the Romanian stock exchange, and their revenues will be affected by the new tax. According to the calculations of some brokers, the impact this tax will have on the EBIT (earnings before interest and taxes) of Transelectrica in 2013 will be approximately 10 million lei. The impact of the tax on the EBIT of Transgaz this year is estimated at about 20 million lei, the quoted sources say.

Some brokers say that these additional costs are not very high for the Romanian carriers of electricity and natural gas and they predict that the evolution of the shares of the two companies will not be affected.

Dumitru Beze, the president of the Association of Capital Market Investors (AIPC), said: "We want all these taxes to be discussed and debated with investors first, even if Romania's position in the relationship with the IMF does not leave much room for negotiations, and even if these taxes bring extra revenue to the state budget. The draft Ordinance on the taxation of the energy sector was only put up for public debate two weeks before its implementation. Under these circumstances, it is hard for investors to build business-plans over the long term. The fiscal system should be stable. "

•

Following the liberalization of the natural gas market this year, along with the special tax, companies operating on that market will pay increased VAT, royalties, fees, profit tax, and which have been estimated for 2013, with an estimated total of 214.1 mil lei. According to the Ministry of Finance, the liberalization of the electricity market will bring an estimated 153.4 million lei in additional VAT and profit taxes to the state budget in 2013.