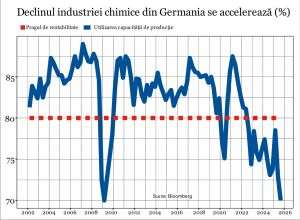

Financial markets may be losing patience with Romania's high fiscal deficit, Daniel Dăianu, president of the Fiscal Council, warned, noting that the seven-year deficit reduction plan risks being too slow for some investors, Reuters reports.

We note that, according to the 10-month budget execution, published yesterday by the Ministry of Finance, we have a budget deficit of 109.42 billion lei, or 6.19% of the Gross Domestic Product, compared to the deficit of 62.81 billion lei, or 3.91% of GDP for the ten months of 2023.

Reuters journalists show that the presidential and parliamentary elections will also lead to an increase in public spending, which will determine a deficit of around 8% of GDP at the end of 2024. At the end of last month, the Government sent the European Commission a plan to reduce the deficit below the 3% of GDP threshold in seven years, a document based on which rating agencies and analysts anticipate that we will witness tax increases next year. Given that Romania has some of the lowest taxes in Europe, there is potential for increasing revenues to support the budget, Daniel Dăianu said, without specifying whether this would involve higher taxes or improving tax collection.

"It is not an impossible mission, but it will be extremely difficult," Daniel Dăianu said at a conference in Budapest on Romania's fiscal plans, quoted by Reuters. "Seven years seems a reasonable period, but I have no information about the patience of the markets. If we are not prudent, the financial markets will force us. If we make big mistakes, we will be punished," the head of the Fiscal Council said at the same event.

However, Dăianu noted that Romania's public debt, at 50% of GDP, remains "manageable," and EU membership and cohesion funds offered to poorer states in the bloc play a significant role in economic stability.

This month, the European Commission estimated that Romania's budget deficit will remain around 8% of GDP over the next two years if policies remain unchanged, partly because of the costs of pension reform and rising interest payments. Officials in Brussels say they cannot take into account Romania's proposed deficit-reduction measures from October because they are insufficiently detailed. Moreover, economists at Goldman Sachs say that the backlash against traditional parties in Romania's presidential elections could complicate efforts to control the deficit.