Medias-based drilling company Dafora (RASDAQ:DAFR) has recently caught the attention of investors interested in acquiring significant share packages, according to Gheorghe Calburean, who holds 48.58 per cent in the company.

"I have received offers for significant share packages from certain "well-intended" people, but I refused, because I did not think that they were trustworthy enough. If I had wanted to sell, I would have done it a long time ago, when the context was right," Calburean said on Friday.

Nine months through the year, Dafora reported a net profit of 1.62 million RON (383,000 EUR) down six times from the corresponding period of 2008, amid a decrease in turnover and profit margins in the construction sector, Dafora representatives said on Friday. The company had landed a net profit of 9.87 million RON in the year-earlier period.

Dafora"s turnover decreased to 116 million RON (27.4 million EUR) in January - September 2009, from 186.4 million RON a year before. Revenues decreased by one third to 147.7 million RON (35 million EUR), whereas expenses receded by 30 per cent to 146.04 million RON (34.5 million EUR).

Dafora was the subject of notable trading early this year, when the brothers Cristescu, some of the richest Romanian businesspeople, reported ownership of 5.26 per cent in the company. About a month later, the Cyprus-based Rosintaly Management Limited reported ownership of 5.4 per cent in Dafora and subsequently sold a part of its stake.

Dafora shares have been the subject of intense speculation on RASDAQ for several months, the price surging over 50 per cent between 21 September - 21 October. However, Calburean believes that the price of DAFR shares on RASDAQ does not reflect the actual value of the company.

"Indeed, Dafora is perhaps the most liquid company on the Stock Exchange after the financial investment firms, but the price of DAFR shares is far from reflecting the value of the company. In my opinion, there was still room for growth even in the glory days of the Stock Exchange, in 2007, when Dafora and Condmag had a combined value of 400-500 million EUR," Gheorghe Calburean commented.

He explained that most of the speculative trading involving DAFR shares this year was initiated by certain shareholders who wanted to test the liquidity of the drilling company. "There was a company from Cyprus that bought and then sold. When I found out who was behind the company, I asked them why they had done so and they told me that they had wanted to check the liquidity of the shares," Calburean said.

• Dafora wants to tap Kuwaiti drilling market

Returning to international markets is one of Dafora"s principal objectives for the near future, after most of the company"s foreign drilling operations went into stand-by mode as a consequence of a financial standstill experienced by energy companies. Ukraine provides the most relevant example in this case, as Dafora"s partner ran out of funds and thus forced Dafora to freeze operations in that country.

"We are having talks with three companies in Ukraine, besides the one we already have a contract with, and, based on my experience, I estimate that we will sign a contract with one of these three companies next Spring," said Teodor Orzan, Head of Dafora"s Drilling Division.

Dafora is also looking very carefully at the Kuwaiti market, trying to achieve pre-qualification for future local tenders. "We have taken steps to obtain a pre-qualification for the Kuwaiti market, which is a pre-requisite for participating in Kuwaiti tenders. We hope that the process will be completed in two or three months. Only pre-qualified companies are invited to tender. The benefit of working in the Arab world is that contracts are usually signed for longer periods, such as two years, for example," Orzan further explained.

Dafora is also very much interested in the Libyan and Iraqi markets, but has decided not to approach the latter for the time being. "We have had ten meetings with as many Iraqi companies over the past ten months, but we have decided not to enter this market for the time being, although we are paying distinct attention to Iraq," Orzan added.

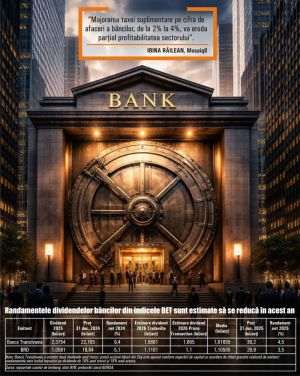

• Banks, the companies" archenemy

Banks were willing to negotiate alternatives with businesses experiencing financial shortage last Spring, but now their approach has changed radically, according to Gheorghe Calburean, the leading shareholder in Dafora. He believes that banks have come to be regarded as the archenemy of construction companies, as this is one of the industries that have been the most severely affected by the crisis.

"Dafora has not had any problems with the banks. We have never been blacklisted, because we have always paid our debts. This year, we have been trying to stay as far away from banks as possible, and I am happy to say that we have achieved this goal. However, if we secure firm contracts and it becomes necessary, we will turn to banks for the necessary operating capital," Calburean added.

Drilling has summed up to 80 per cent of Dafora"s operation this year, whereas constructions stand for the remaining 20 per cent, company representatives indicated. According to an announcement made on Friday, the intention is to change the strategy concerning constructions, considering the ongoing crisis.

"Many shareholders asked us how we should get rid of the construction operations, but we have decided to stay in the construction business, because we already have a good name and a good portfolio of achievements in this business (i.e the Sibiu International Airport, the Romgaz Head Office in Medias etc)," Gheorghe Calburean said.

"We have not even attended tenders for small contracts lately, because we want to focus on getting major contracts. We no longer want to be good at everything, but become a general contractor and subcontract some of the works," Calburean added.

• Calburean sees geothermal energy as a solution for Transylvania

Gheorghe Calburean is planning to use geothermal energy as a source of heating for the western part of Romania via Transgex - Oradea, which is controlled by Dafora Turism with 96.68 per cent.

"We are trying to develop several projects involving alternative sources of energy as a solution for heating. For example, all of the heating requirements of the town of Beius are covered by the thermal energy derived from the geothermal water we process. We are having talks with the authorities of Oradea to provide this town, too, with a similar solution for heating," Calburean said.

Charcuterie is another business in which Gheorghe Calburean intends to build a reputation. He bought the Salconserv charcuterie factory in Medias in 2004 and subsequently retooled it with 6.6 million EUR worth of SAPARD funding. Salconserv currently operates 11 proprietary stores in the western part of Romania.

• Condmag Profit Doubles In 9 Months

Dafora Group, which comprises Dafora and Condmag, reported 17 million RON in profit for the first nine months of the year, down by 1 per cent from the year-earlier period. Condmag drove Dafora Group profits with a 100 per cent surge to 18.3 million RON (4.3 million EUR).

The company also reported revenues of 191.8 million RON, up 1.8 times from the corresponding period of 2008. Nine months through the year, Condmag"s expenses increased 1.8 times from 93.8 million RON to 170.4 million RON, according to a report to the Bucharest Stock Exchange (BSE). The turnover increased 2.1 times to 187.6 million RON, from 86.1 million RON in the first nine months of 2008.

Construction and drilling company Dafora - Medias controls 44.64 per cent in Condmag, whereas OGBB A. Van Herk BV - Rotterdam is the second leading shareholder with 10.85 per cent. The company specializes in building master pipelines for natural gas, oil and water.

Ovidiu Vrânceanu, Braşov