In a year when more than four billion people are eligible to vote in global elections, geopolitical concerns have emerged as a top concern for central banks and sovereign wealth funds, according to a report by asset management company Invesco. published by the World Economic Forum (WEF). The analysis shows that the increasingly polarized and fragmented political landscape has surpassed inflation as the main risk factor for these institutions.

The trends highlighted in the cited study, called Global Sovereign Asset Management 2024, reflect an increasingly complex and uncertain world for central banks and sovereign wealth funds, with 83% of respondents considering geopolitical tensions as the main risk to global economic growth next year, and 73% - high inflation and the tightening of monetary policy. Looking ahead to the next decade, 86% of survey participants identify growing geopolitical fragmentation and protectionism as the most important long-term threat.

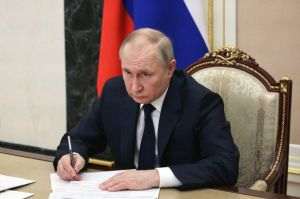

According to the survey, ongoing conflicts in Ukraine and the Middle East, tensions between major powers, including the US and China, and uncertainty surrounding the outcome of the 2024 elections are driving this increased focus on geopolitical risks.

• Central banks consolidate and diversify their reserves

In response to these challenges, central banks consolidate and diversify their reserves. More than half of them (53%) plan to increase the volume of their reserves in the next two years, while 52% intend to further diversify their holdings, according to the cited survey. This strategy aims to create a buffer against potential shocks and ensure sufficient resources for interventions in the event of market disruptions.

The Invesco study also points to a growing focus on gold and emerging market assets as a means of diversification for central banks and sovereign wealth funds. Thus, gold has become more attractive for 56% of respondents, while allocations to emerging markets are expected to increase significantly over the next five years.

As sovereign investors adapt to this changing landscape, their strategies reflect a fine balance between managing immediate geopolitical risks and positioning for long-term stability and growth.

• No quick fix for global uncertainties

The social and economic instabilities arising from geopolitical tensions will persist in the future.

The World Economic Forum's Global Risks 2024 report found that two-thirds of respondents to this year's risk perception survey believed that "a multipolar order will dominate over the next ten years, as middle and great powers establish and impose - but also challenge - the current rules and norms".

The survey found that 54% of respondents expect a degree of instability and a moderate risk of global catastrophes in the next two years. Another 30% foresee even more tumultuous conditions during the same period. Looking further, towards the ten-year horizon, the perspectives become much more pessimistic, with almost two-thirds of those surveyed anticipating "stormy or turbulent" circumstances.

• Strategies for returning to a more stable order

In addition to highlighting geopolitical tensions and the polarized nature of global political discourse, the Global Risks Report sets out a series of strategies, from the nation-state to the individual, for a return to a more stable order.

Large-scale cross-border collaboration will be crucial in the event of armed conflicts between nations or other threats to human security and prosperity, notes the cited source. In addition, localized investment and regulation can be used to mitigate foreseeable risks, with both the public and private sectors playing crucial roles, the report said.

When faced with challenges on a global scale, individual actions may seem insignificant. But the report points out that, taken together, small actions can significantly reduce global risks.

The next decade will bring unprecedented changes, testing our adaptability, concludes the quoted source, stressing that current efforts to address global risks can generate a positive result.