• 4.8% drop for the BET, in 2018, which enters the new year at a level it hasn't been at since January 2017

• Only the dividends have saved the overall picture of a bad year for the Romanian stock market

• The daily turnover on the BSE is stagnating

The Bucharest Stock Exchange (BSE) enters 2019 on a note of pessimism, as the Romanian stock market saw one of the most severe shocks it ever experienced in its over 23 years of operation since its recreation in 1995 and definitely the hardest caused by internal factors, when, in the second half of December, the Minister of Public Finance, Eugen Teodorovici, has announced the intention of the government to implement a number of fiscal-budgetary measures with a profound impact on the activity of the BSE.

This was a blow which showed investors that on the stock market, they are sailing the stormy waters of Extremistan, meaning the land where anything can be dramatically affected even by one event, like the one of December 19th December, when, as a result of the statements made by Teodorovici one evening ago, prices on the BSE saw the biggest drop one day after the global crisis of 2007 - 2008, and the BET index fell 11.21%, which not only melted the entire advance of 8.58% seen the stock basket had seen by that time in 2018, but actually took it into negative territory, which is how it ended the year.

Furthermore, the BET will start in 2019 from the level of 7,384 points, a threshold which the market benchmark hasn't run into for about two years (the end of January 2017) when, in contrast to the current drop, the index was on an upward trend.

Thus, starting with December 19th, the only parameter which hinted that the Romanian stock market would stand out with was erased, because the BET index had had in an impressive trajectory in 2018, compared to the most important exchanges in the world or in the region.

Besides, for the stock markets, 2018 was the weakest year in the last decade, since it was for the first time since 2008 that all the three important indices of the exchanges in the United States of America (Standard & Poor's 500, Dow Jones Industrial Average and Nasdaq Composite) dropped, according to CNN.

• Alin Brendea, Prime Transaction: "The effects of the fiscal changes at the end of the year are not yet fully quantifiable"

Alin Brendea, deputy director of brokerage firm Prime Transaction told us that from his point of view, the block of fiscal changes presented by the government in the last days of December, represent the most important event of the BSE, in the recently concluded year.

"The effects of these measures, with a major impact on the majority of the top issuers listed on the Romanian stock exchange, are not yet fully quantifiable, but they have already had the most important impact in 2018", the head of Prime Transaction said.

The Emergency Ordinance which has already been published in the Official Gazette and came into force on January 1st, includes the application of a progressive tax on bank assets based on the level of the ROBOR index, the capping of the price of domestically produced natural gas at 68 lei/MWh, a 2% tax on the turnover of energy companies and 3% on telecom companies, as well as a reformation of the framework for the functioning of the pension system which requires, among other things, the increase of the share capital of the managers of IInd Pillar private pension funds, the capping of the contribution pillar to 1% and the amendment of that applied to assets, depending on the performance of the fund.

Other than that, things were quiet on the BSE and only the generous dividends granted by many of the significant issuers listed on the Romanian stock exchange, in some cases through the intervention of the state which once again squeezed money out of the companies it controls, have made the investors which track the BET index to post a gain of 4.3%, the yield of the BET-TR index.

Liquidity, the major problem of the Romanian market, has stagnated, as the daily turnover fell to 46 million lei, about 4% below that of 2017 and it would have been even lower without the December blood bath, when impressive turnovers compared to the regular ones on the BSE were seen.

Besides, the collapse of the market in the last sessions of the year has also affected the capitalization of the market. The total valuation of the companies traded on the BSE (including Erste Group Bank) on the main tier at the end of 2018 was 142.98 billion lei (approximately 30.66 billion Euros), about 13% below 2017, when the historic record of 164.4 billion lei has been reached.

Neither the listings of the private companies have kept up in 2017 (which saw four listings). In 2018 only Purcari Wineries (WINE) got listed on the Bucharest Stock Exchange, whereas the state has long been absent with the listings of its companies.

The listings of bonds issues have continued, however. Those that stand out are those of the real estate investor Globalworth (GWI), amounting to 550 million Euros, as well as the bonds launched by Banca Transilvania (TLV) and Internaţional Investment Bank (IIB), with blocks amounting to 285 million Euros, representing 80 million Euros, respectively.

Unfortunately, the liquidity of these securities on the BSE is very low, as the situations where the market participants trade bonds, especially among those with a high face value, are very rare.

In this context, Alin Brendea of Prime Transaction has identified two important factors which have led to the occurrence of the situation described above.

"The first concerns the negative mod which has dominated the international stock markets in the second half of 2018. That sentiment has probably affected the willingness of institutional investors to support the new listings, as well as their trading activity", Mr. Brendea explained, and he added: "The second factor concerns the process of the market adapting to the new MiFID II legislative framework. More regulations have occurred, there is an effort to assimilate them which determines a shrinking entropy of the stock market".

Ovidiu Dumitrescu, deputy manager of brokerage firm Tradeville, told us that in 2018, the number of new listings was lower than in 2017.

"It's probably due to the fact that in 2018, the environment has been far more volatile, more difficult than in 2017", the Tradeville director said.

• Ovidiu Dumitrescu, Tradeville: "Last year, both domestically and externally, politics has had a stronger effect than usual"

Concerning the elements which have influenced the Romanian stock market in 2018, Ovidiu Dumitrescu told us: "We've had a year where, both domestically as well as externally, the political factor has weighed more than the usual. The backdrop was one where the Federal Reserve has continued to raise the policy rate, and the price of oil has risen significantly, which boosted the stocks of oil producers.

But in the second half of the year, oil prices have dropped, and the levels of returns on US government bonds started weighing increasingly heavier, forcing the Fed to backtrack slightly in November".

According to the manager of Tradeville, the US strategy to levy import duties on its partners has led to a deteriorating international situation, which has also influenced the developed stock markets, which have seen significant drops off their annual highs.

"All in all, a year with more volatility and less visibility than the previous one", Mr. Dumitrescu said.

Also, the Tradeville representative has emphasized that domestically, the payout of significant dividends by the local companies has helped the Romanian stock market decouple from the negative evolutions of the international markets.

Speaking again about elements from the domestic area, Alin Brendea of Prime Transaction has noted the preservation of a positive economic climate, even though it was somehow worse over the year 2017.

"This has allowed companies listed on the BSE to post good financial results, which have maintained the attractive nature of the issuers in terms of their fundamental analysis. On the other hand, the political decisions have affected the local market, with a maximum impact at the end of the year, when the exchange posted the most drastic daily drop in the last few years", the representative of Prime Transaction said.

Alin Brendea a adăugat: "From abroad, we have been influenced by the corrections of the European markets and that of the United States. The rise of the borrowing costs in the American economy has led to a slight increase in aversion on a global level. Still, we could note the better evolution of the local market compared to other stock markets, concerning this negative factor".

• "Banks and the energy sector - preferred by investors in 2018", brokerage firms representatives say

Companies that have paid out significant dividends or have distributed free shares have been the focus of BSE investors, in 2018, the directors of brokerage firms have told us, who have indicated the banking, energy and utility sectors as accounting for the bulk of trading on the BSE in 2018.

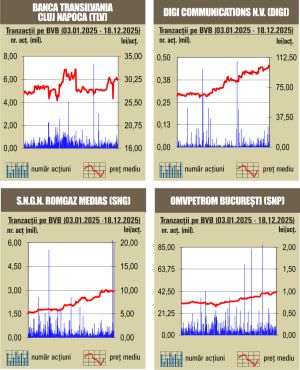

Banca Transilvania, the most liquid issuer on the BSE, has paid out to shareholders, last year, a total of 610 million lei, representing over 50% of its net 2017 profit, of 1.186 billion lei. The bank has also allocated 471 million lei in free shares, as part of a share capital increase.

BRD - Groupe Societe Generale (BRD), the other liquid issuer of the Romanian stock exchange, last year paid out dividends of 1.14 billion lei, the equivalent of 83% of the net profit of 2017, of 1.38 billion lei.

Romgaz (SNG), Nuclearelectrica (SNN) and Transgaz (TGN) have paid out 90% of the 2017 profit, as well as additional dividends, whereas Conpet (COTE) has paid out money to shareholders only out of its 2017 result, and Transelectrica (TEL) is going to pay out additional dividends in the beginning of this ear. In all those cases, the decision was made by the Romanian State, the majority shareholder of the companies.

OMV Petrom (SNP) has allocated to shareholders, in the year that was recently ended, the amount of 1.13 billion lei, the equivalent of 45% of the profit seen in 2017, of 2.481 billion lei.

On Thursday, in the first trading day of 2019, the BET index rose 1.18%, to 7,471.1 points, whereas the entire turnover posted by the BSE was 32.51 million lei, below the median daily value of last year.

Note:

The Extremistan concept was developed by Nicholas Nassim Taleb in his work "The Black Swan - The impact of the highly improbable" and defines situations in which the whole or the total is strongly affected by very few or even by one observation or event. Conversely, in Mediocristan, no observation or event can have that great an impact so as to substantially change the whole.

For instance, if we randomly pick 1,000 people whose median weight is 100 kilos and then we add to that population the fattest man in the world, which weighs let's say 400 kilos (four times higher than the average), the impact will be insignificant, representing only 0.04% of the total weight of the population.

Then, if we think of the fortune of the same 1,000 people to which we add that of Jeff Bezos, the richest man in the world, of approximately 110 billion dollars, the impact on the total will be enormous, as Bezos's wealth represents over 99.99% of the entire population.

Weight is a size in Mediocristan, and fortune in Extremistan.

The oscillations of the market quotations are part of Extremistan, says Taleb, which means that in the long term, only a very low number of trading sessions produce the bulk of the total return of the period.