• The head of the Central Bank even claims that Romania might see economic growth this year, even though the rest of the European Union"s countries have announced massive economic slowdown this year

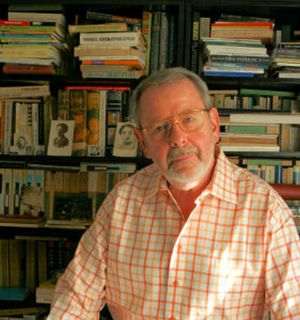

The Governor of the National Bank of Romania, Mugur Isărescu, said on Friday, while in Braşov, at the conferences of the Romanian Banking Institute, that he was extremely optimistic on the chances of our country to see economic growth this year, even if it might not exceed 1 - 2%, which would be very good considering the fact that most countries of the European Union have announced major slowdowns of their economies. "The Euro zone will be the most severely affected, it seems", the governor said in Bra1ov. Moreover, Isnrescu added that this spring, "let"s say in time for the equinox", lending will be unfrozen.

Isnrescu feels it is very likely that Romania"s economy will grow this year, because it is not tightly tied to the states affected by the Crisis. "It"s true, we are part of the European Union, but our revenues from exports are only 25 - 30% of the GDP, as opposed to 70% of the GDP for the Czech Republic", Isnrescu explained. He criticized the Romanian state institutions of doing a poor job, as they failed to attract the structural funds the European Union made available to Romania.

"Romania will have to win back the market for its food industry, an industry which it doesn"t even have anymore. We"ve focused on the auto industry, and when German carmakers have problems, component makers in Transylvania have problems as well", Isnrescu said. He stated that Romania might benefit from the fact that it"s economy revolves around agriculture. "In the countryside, people aren"t concerned about the crisis, they"re more concerned with whether it"s raining or there"s a drought", he said, adding that Romania could see great benefits if it managed to get its agriculture in shape.

Also, Isărescu said that there is a noticeable contraction of non-government borrowing, which will naturally lead to an increase in government borrowing. "We will have to borrow money from European financial institutions. We will also have to expedite infrastructure investments, because private sector investments are frozen for the time being", said. Mr. Isnrescu, adding that his function is to help maintain confidence in the Romanian economy, as the psychological element is extremely important for enduring the crisis.

• The private sector is cutting down on spending

The Governor of the NBR said that, two years ago when he was urging banks to stop lending money so lightly, he was "constantly reviled". "I see they"re keeping quiet now", Isnrescu said, who further said that two years ago, as lending was booming, "Romania"s standard of living exceeded its output by 14%, and last year, when they found that orders are dropping, private companies have begun slowing down, downsizing or even cutting wages, while the public spending increased, with the public spending deficit reaching 5%". "Overall, last year"s standard of living exceeded the output by 12%, but it was first and foremost the private companies that cut back on their spending", the head of the NBR said.

• Constructions aren"t going to crash

According to the NBR official, the constructions sector isn"t going to crash, as the ongoing private investments will continue, and new construction sites will be launched.

"Part of the private investments can"t be put on hold, because the works are in progress. Only a small number of construction projects will be shut down. On the contrary, the most visible aspect will be the launch of new construction projects. The media coverage of construction projects being cancelled should not cause us to worry. Besides, the number of construction permits has increased for the period of December 2008, - January 2009. People are still building and I don"t think we"ll experience a crash in this sector", Isnrescu said.

• Euro could have reached 2.5 lei

Isnrescu said that two years ago, the Romanian Central Bank propped up the Euro, as it could have reached 2.5 lei, because sizeable foreign funds entered Romania, not only via banks, by also via the leasing companies. "Until summer, the foreign capital was rushing into Romania, and then it suddenly stopped, which caused a great imbalance of our currency", Isnrescu said, who added that the leu only fluctuated by 25%, while the Polish zloty, for instance, fluctuated by 40%, which shows its greater degree of reliance on foreign capital.

• Foreign banks are not bringing their profits home

Isnrescu answered a question asked by businessmen from Bra1ov, who claimed that it would be much better if the foreign banks didn"t fully repatriate their profits, an alternative solution being capitalization. "We have already received signals from the banks that they won"t take out their profits, but rather they will reuse them for capitalization, which means that they will be able to lend as much as eightfold their profits", Isnrescu said.