• Isărescu: The weakening depreciation of the leu is a reaction to the political evolutions

• Cristian Cochinţu: The level of 4.5 lei seems imminent, and a fall back to 4.32-4.35 would only be temporary

Yesterday, the Euro reached a new historical high for the second time this week, as the National Bank of Romania announced an official exchange rate of 4.4168 lei/Euro. Yesterday's reference exchange rate was 1.98 lei higher than the one of Monday, when the Euro posted a new record, being quoted by the Central Bank at 4.3970 lei/Euro.

The maximum reached by the Euro yesterday was 4.43 lei, market sources said.

According to the aforementioned sources "in the morning, the Euro opened at 4.4255-4.4275, and in the afternoon it reached 4.43. Around 17:00, trading was taking place at 4.4190-4.4210".

Yesterday's trading volumes were not big, but there was interest from foreign investors in the Euro, according to the aforementioned sources, who said: "This was speculation over a moment of instability. After a calm period, we are witnessing these days of consecutive depreciations, as the interest rates on the interbank market are also generally low".

The dealers claim that the depreciation of the leu was slowed down by the interventions of the NBR, which conducted indirect sales of Euros.

Cristian Cochinţu, financial analyst at "Admiral Markets", considers that the decline of the leu will continue.

He said: "the EUR/RON exchange rate entered an upward trend last year, after the critical resistance threshold of 4.3 which stood in place for the last three years gave way. It wasn't a surprise, just a normal continuation of the upward trend, which has sparked off investor's interest. From a fundamental point of view, the dropping yield of the leu has amplified the decline. There are no reasons to believe that the trend will change soon, 4.5 looks imminent, and a return to 4.32-435 would only be temporary and the decline of the leu would continue".

Since the replacement of the Government, and until now, the Euro has gained over 1% against the leu, and almost 2.19% since the beginning of the year.

"It is far too much to talk about a crash, it's just a few percent since the beginning of the year, but the Romanians had gotten used to a stable exchange rate, with a slow decline, which may stabilize at 4.5 lei", he said.

The forint lost 23% in the second half of 2011 and then gained 12% this year, according to the financial analyst.

When it comes to yesterday's decision of the NBR, to keep the policy rate at 5.25%, Cristian Cochinţu thinks it will have no effect on the exchange rate, because it was expected. More important is whether the NBR will continue the easing policy or not, he said.

"If the vision of the NBR changes after the current evolution of the exchange rate and the political developments, the RON will strengthen, as the market is already speculating that the NBR will cut the policy rate in the future as well, but we will have to see what clues the governor of the NBR gives us and how the market will perceive them", said Cristian Cochinţu.

He went on to say that it is "very difficult" for a central bank to control the exchange rate in the long run, especially through interventions: "The NBR can maintain the high interest rate and would thus keep the leu attractive and would eliminate the speculation that it will be cheaper in the future, but on the other hand that would affect the economic growth".

The financial analyst of "Admiral Markets" considers that the policy rate should have been cut more aggressively last year.

Economic analyst Ionel Blănculescu considers that the replacement of the government lead to a change in the exchange rate which was "not very big", which had actually been anticipated since the end of 2011, with very low margins.

He said: "The sooner the new government is installed, the sooner this transitional exchange rate will return to where it was before the Ungureanu government fell. Such oscillations happen when there are political events of the kind".

Yesterday, the NBR posted an exchange rate of 3.35994 lei for the American dollar, up 3.54 bani over the previous session. The Swiss frank also gained against the leu, rising to 3.6756 lei, up 1.63 bani over the previous quote.

• Isărescu: The leu is reacting to the political developments

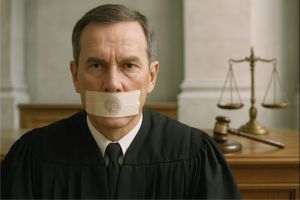

The depreciation of the leu against the Euro, which reached a historic level yesterday, seems to be a reaction to the political developments, Mugur Isărescu, the Governor of the National Bank of Romania (NBR) said.

He did warn, however, that it is possible that the fundamentals lead to a shift of the fluctuation range of the exchange rate, after the inflation differential has been detrimental for Romania over the last three years. "We have four months where we had two government changes, a month of social protests and a rather harsh winter", he said.

Mugur Isărescu, said, however, that the depreciation of the leu was not one of amplitude and it has not exceeded 2-3%. The governor of the NBR explained that the big movements did not occur in Bucharest, but in London and New York, as ten billion lei are held by non-residents, whose behavior is more difficult to control, missing correct messages from out authorities. "Investors don't need much information, hey can change their behavior on a mere snippet of information", he warned.

In Bucharest, things were a little more steady, as the designated PM Victor Ponta announced that the macroeconomic policies would continue, by honoring the agreements with the International Monetary Fund, the European Commission and the World Bank, according to the governor of the NBR.

Mugur Isărescu said that he sees no possibility for the social security contributions to be cut in the next six months. On the other hand, the decision to restore the wages of public sector workers was predictable, he said.

• The appointment of Florin Georgescu as Minister of Finance - a guarantee towards avoiding slip-ups

The appointment of Florin Georgescu as Minister of the Public Finances and the Deputy Prime Minister represents a guarantee that the budgetary policies will not lead to slip-ups, according to the governor of the NBR. He explained that from the point of view of the cooperation between the Ministry of Finance, and of the mix of fiscal and monetary policies, the decision represents a definite gain. "We will get to cooperate with a man who has a vast expertise in the financial and fiscal area, as well as in the banking area, we know each other, he is a professional and he was a very good colleague", the head of the central bank said. (ALEXANDRU SÂRBU)