• The bank announced that it would lay off almost 20% of its staff

• The unions don't have a clue about the decision of the management: "We are worried about the situation of the colleagues who will be laid off"

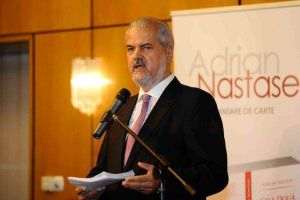

• Tomas Spurny: "At the present time, the sustainability of the business involves cost cutting"

In the next 12-18 months, the Romanian Commercial Bank (BCR) will lay off 1,600 employees which represent 17.5% of their total number of employees, Tomas Spurny, the CEO of the bank said yesterday, on his first official appearance in Romania. He has explained that over 60 unprofitable branches will be closed, and the number of employees will be cut from 9,100 to 7,500.

The union officials said that they haven't been informed about the number of employees who are going to be laid off.

"The first and only meeting, so far, on this subject, was held last week, and up until that moment we had no information concerning the staff which needed to be laid off in the coming period", said Ciprian Ionescu, the president of the Federation of Independent Unions of BCR.

He added: "I understand that Mr. Tomas Spurny has said today (ed. note: yesterday) that the restructuring plan hasn't been negotiated with the unions of the bank. The negotiations/discussions with the employer have not begun yet, but considering the number of those who will be laid off, it is obvious that we are talking about and we need to consider the legal obligation of the employer to begin talks for the information/consultation and collective layoffs. Such steps will be taken this week".

The number of people who are about to be laid off is very big, according to the unionists, who are waiting to find out how the remaining employees will be affected, after the implementation of the restructuring plan.

"We are concerned about the situation of our colleagues who will be laid off even as the labor market is still flawed and they still have debts to pay off", said Ciprian Ionescu.

The number of employees who will be laid off following the decision of the employer to shut down the 64 territorial retail units is insufficient compared to the proposed target and employees in other areas of the business will be laid off as well, according to the president of the Federation of Independent Union of BCR.

Ciprian Ionescu added: "The National Union of the Employees of the Romanian Commercial Bank (SNS BCR), union which I represent now and which was created in mid-2012 by the merger of 39 union organizations legally created within BCR, is concerned with the situation of the employees of BCR in relation to the results which the restructuring plans approved by the employer will have on the available jobs, and as part of these collective layoff procedures which will take place at BCR, it will take all the necessary steps to mitigate the effects of the measures taken by the employer, in order to reduce the number of layoffs. It is obvious that the we need to find out details, concrete elements about the intentions of the employer which will lead to these layoffs, based on which we will be able to propose measures to reduce the number of layoffs".

Considered the most successful privatization, BCR was the crown jewel of the banking system. Now, the bank has come to post losses of over 700 million lei, approximately half of the total losses of the domestic banking system.

In yesterday's speech, Tomas Spurny said: "Regardless of what you do, you need to always have sustainability in mind. Some things don't last long, some only work in the long run. If you act quickly without the idea of sustainability in mind, then you create speculative bubbles (...) Whoever is wise will clearly see that the most important thing is how to ensure a good future for the 7,500 people who will stay with the bank".

Tomas Spurny also said that in times of economic growth, banks have a different vision, but as long as growth is far away, bankers are forced to look at costs. According to the head of the BCR, a cost/revenue ratio of 40-50% can't be reached at the moment without restructuring, and its absence would place the ratio at 60-70%.

He went on to say that following the crisis, the business model has changed, and the sustainability of the business currently involves a cost cutting.

The development strategy of BCR for the next five years was only approved recently, meaning that the restructuring plan was not negotiated with the three unions of the bank, according to Tomas Spurny.

• Constantin Paraschiv, FSAB: "The management of the bank may switch to less orthodox methods"

The Federation of the Unions of Insurers and Banks (FSAB) has not received any notice from the BCR, concerning the number of employees who will be laid off.

Constantin Paraschiv, the president of the Federation of the Unions of Insurers and Banks, said: "We have no information about the layoffs announced by the management of BCR. The bank is probably going to call us in for consultations, because they are required by law. I am not surprised at the number of employees that will be laid off. Such a big number of layoffs isn't out of the question.

The problem which concerns us is that the management of the bank may switch to less orthodox methods, such as forcing the employees to leave of their own accord, in order to have the bank be exempted from performing the formalities requested by the labor inspectorate. The lender could offer the employees which decide to leave of their own accord, one, two or three wages more. Under these circumstances, the unions might not be called in for consultations anymore, because it wouldn't make any sense".

The president of the FASB estimates that other banks could resort to staff layoffs as well.

"We estimate that about 10,000 employees in the banking system will be let go in 2013", according to him.

Constantin Paraschiv said that approximately 30,000 employees in the insurance and banking sector will be laid off next year, because their number is too great.

• Gheorghe Piperea: "The employees in banks should think twice before putting their soul into the bank"

It is awful that 17.5% of the total employees of BCR will be laid off in the following 12-18 months, lawyer Gheorghe Piperea said.

He added: "After posting fabulous profits, BCR has posted losses so great that it swung to the other extreme. The layoffs of the employees can not be avoided, considering that in the real-estate boom period they overdid it with the expansion of their network. At that time, there were large volumes of loans being sold and no banking was being done. After six years, the privatization of BCR was not successful. The only positive aspect which resulted from the privatization was that some money entered the banking system, but the system has not become more profitable".

In the opinion of lawyer Gheorghe Piperea, the bank frauds over the last two months show how big the management mistakes made during the period of real estate boom were.

"BRD and Volksbank are the banks which were brought to the attention of the public in the bank frauds case, but at BCR the frauds are ten times bigger, because the bank has granted the most loans on the retail segment", according to him.

The management of the banks received bonuses during the real estate boom period as well as in the present, based on the volume of loans sold, and the effects are felt by the customers, who pay risk commissions as well as by employees.

"Employees in the bank should think before putting their soul into the bank, because the bank isn't going to draw them a statue, instead it will dump them the moment they are no longer needed", the lawyer said.

The president of BCR said yesterday that the bank intends to open new branches in locations which have potential, a process which will get done by the last quarter of 2013 or the first quarter of 2014.

When it comes to the development of the activity, BCR plans to become the first bank in Romania in terms of trading, and this target will be achieved by gradually improving its services and products, which would eventually led to the full use of the bank's infrastructure and improving its profitability, according to Tomas Spurny.

In the Extraordinary General Meeting held in the beginning of December, the shareholders of BCR have approved the amendment of the articles of incorporation of the bank, so that the Executive Committee will be allowed to close branches and agencies without the approval of the Supervisory Board.

Over the first nine months, the number of employees of BCR fell by almost 10%, together with a reduction of its territorial network by about 7%.

Nine-month data shows that the number of employees was reduced from 8,400 at the end of 2011, to 7,600 employees at the end of last year, whereas the number of branches was cut to 621, down from almost 670 in December 2011.

In the first nine months of 2012, BCR posted a net loss of 762.5 million lei (172.1 million Euros), amid record provisions, whereas over the similar period of 2011, it had a net profit of 67.6 million lei (16.1 million Euros).