• Oleg Solomiţchi, the representative of the JLC group, has acquired the receivables of the two large shareholders of the milk producer - ASMC and Olympus Dairy

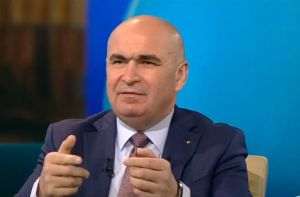

The change of the owner of the Braşov-based company Prodlacta looks likely to see further delays. That is happening despite the fact that Oleg Solomiţchi, the representative of the JLC group of companies, which has acquired over 60% of the company's debts, paid in his own name the receivables of the following shareholders: the Association of Employees and of the Members of the Management of Prodlacta (ASMC) (46,870 lei) and Olympus Dairy (15,967 lei). The purchase of the debts was done according to article 1472 of the Civil Code of Law which stipulates this right. The two shareholders and creditors of the company have also contested this acquisition of the debts, as the court yesterday ruled that neither ASMC, nor Olympus Dairy have any right to be involved in the lawsuit as long as the payment was done according to the legislation in effect.

According to the liquidators of the company, which is currently insolvent, a decision on the reorganization plan may only be made on November 12th, "if all the complaints are solved by then". However, after yesterday's ruling, ASMC and Olympus Dairy lost their legal standing in the lawsuit, and they were removed from the Creditors' List, which might make it easier to transfer the right of ownership to the Moldavian group JLC.

In August, the companies of the JLC group had acquired receivables with a total value of 17.390 million lei, more than half of the total of 34.047 million lei accepted for repayment. Two of the receivables were part of the secured claims. A receivable of 12.616 million lei (2.892 million Euros) had been acquired from BCR by JLC Germany Gmbh, while JLC Dprint Gmbh acquired receivables worth 2.612 million lei (approximately 579,000 Euros) from BRD. Aside from those receivables, the JLC group also acquired an unsecured receivable of 2.162 million lei.

In its reorganization plan, the JLC group has proposed the conversion of the receivables into stock, as well as the granting of an 18 million loan to the milk maker of Braşov, which will also be repaid by issuing stock. The money will be used to pay the debts owed to the other creditors. Following these operations, the JLC group will hold 70% of Prodlacta, whereas the current largest shareholder - the Association of the Employees and Members of the Management of Prodlacta - will only hold 13.49% of the shares, while the Greeks of Olympus Dairy would fall under "other shareholders".

Oleg Solomiţchi, the representative of JLC in Romania, said about a month ago that the group's intentions are quite clear. "We want to invest in Prodlacta. We have proven our earnestness by having already invested almost four million Euros. We want Prodlacta to become one of the leaders on the Romanian dairy market in the coming three years", the quoted source said. One of the first steps which the company will take after JLC gains control would be to build a nationwide direct distribution scale, starting with Braşov and Bucharest, which will then be extended across the entire country. "This would mean warehouses all over the country, our own sales force with everything that comes with it. We think that the fact that the Prodlacta brand has its origin in Braşov provides remarkable advertising opportunities, which we intend to fully use", the quoted source also said.

The Moldovan investors have made it their goal to bring output back to its peak level of the past few years, which would mean hiring back all the staff which was laid off over the last few years. In 2007, prior to the beginning of the crisis, Prodlacta had an average number of 468 employees, whereas at the end of last year, their number had fallen to 164, and now their number is half that, according to information from inside the company.

"We will continue investing in the plant in order to enhance the portfolio with new products. Some of these products already exist on the market, but they do not exist in the portfolio of Prodlacta, and others are products which JLC sells in other countries, but which do not exist on the domestic market. We will develop the ice-cream segment, which Prodlacta hasn't tapped in the last few years", Solomiţchi also said.

The JLC Group owns milk plants in the Republic of Moldova (JLC and Incomlac), in Ukraine (JLC), in Kazakhstan (FoodMaster - Ice Cream Company and JLC Sut).