The first quarter of 2009 is almost past, while the efficiency of the governments" crisis solutions is yet to be witnessed. Governors of central banks and prime ministers are now trying to highlight the importance of optimistic expectations in order to avoid economic depression. It was exactly irrational exuberance - especially in Eastern European emergent economies - that brought us here. Interests, short-sightedness or ignorance made authorities deny all warnings until the last moment.

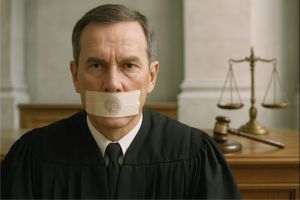

Disregarding the huge economic and financial imbalances generated by the cheap money policy which caused historically unprecedented debt across the world, governments and central banks engaged in an irresponsible crusade to sustain the unsustainable. Closing their eyes in the face of the speculative orgy we witnessed until not so long ago in order to offer the hope of eternal prosperity to gullible voters, they have created an interesting similarity between the authorities" cheap money "fair" and Dorian Gray, the character of Oscar Wilde who sold his soul for eternal youth. Hidden from the eyes of his friends, Dorian Gray"s portrait took over all his sins and would only show his true face to him.

It was not just the emergent economies that had such paintings of their own. In fact, Eastern Europe learned from the "masters" of European socialism how to create the illusion of prosperity and will probably learn how to "allocate" responsibilities, too.

British Prime Minister Gordon Brown has decided that he wants to regulate the banking system to the bone. "It"s time to set new rules for the banks of all countries," Brown told a Labour forum in Bristol. The head of the Financial Services Authority begged to differ. Lord Turner told a committee of the House of Commons that former Chancellor of the Exchequer Gordon Brown (in which capacity he used to directly supervise the FSA) had put pressure on the regulator not to stand in the way of the lending spree, according to The Telegraph.

A recent article in the same newspaper was wondering whether we reached the breaking point of the EuroZone. The background included a presentation of the dramatic situation in Ireland. Germany"s former Foreign Minister Joschka Fischer believes we will soon find out whether the result of the decision to create the EuroZone is a disaster or not, despite the assurance given by Jean-Claude Trichet. Can Germany rescue insolvent states in an electoral year and under mounting social pressure?

Across the Ocean, the authorities only care about cosmeticizing the economic and financial picture scarred by abuses. The Citigroup part of the picture received a facelift late last week, but the market will not believe anything anymore. Goldman Sachs analysts recommended investors to avoid Citi shares shortly after the announcement of the latest restructuring of the former financial giant as they were not convinced it was also the last one.

Christopher Whalen of the Institutional Risk Analysis, believes that the new agreement between Citi and the Government will not solve the cash flow problem, nor will it stop lending losses, according to a Bloomberg article. Not even an optimist as big as Warren Buffet, who has just unveiled the poorest results posted by Berkshire Hathaway in the last 44 years, sees the crisis fade in the next few years. And he is not just an optimist, but an optimist with money, who was directly involved in the rescue of major Wall Street banks. What can an optimist without money do? One who has just learned that the instalment towards his mortgage loan has increased because the national currency has depreciated?

Through the budget submitted to the Parliament, the Romanian Government has proven they understood nothing about the ongoing world crisis, as its effects on a profoundly imbalanced economy have been grossly underestimated. Romania is not facing just a storm that may ruin its crops, but a devastating economic and financial hurricane. It appears that we are going to have to wait for the "results" of the economic stimulus packages in the developed countries in order to be convinced that the solution must be sought elsewhere. Our authorities did not have the time to notice the systemic collapse around us, which became visible in early 2008, if not before, but they did manage to discover, just a few days ago, the financing requirements for 2009. Where was the 20 billion EUR "hiding" until a few days ago?

It is particularly for emergent economies that the picture of the true economic reality must be exposed in plain sight. Nevertheless, it was overlooked, as everybody was busy buying property. When Dorian Gray decides that only by full confession can he achieve absolution, he destroys the portrait - a futile attempt to eliminate not the causes that had "aged" the painting, but the consequences of his own actions. Guilt and fear of responsibility determined him to renounce his conscience instead.

The fiscal and monetary authorities of today have chosen the same exit. And we all know what happened to Dorian Gray...

Disclaimer: This article reflects solely the point of view of the author. It does not reflect or imply the opinions of his employer and does not constitute an investment recommendation.