In the first meeting with journalists this year, after last week's monetary policy meeting, Mario Draghi said that risks have increased for the economy of the Eurozone.

A few days later, the president of the ECB said before a commission of the European Parliament, that the resumption of the quantitative easing is possible if the situation gets worse, but such an action is unlikely this year, meaning prior to the ending of his term as head of the ECB.

The printing progam of the European Central Bank ended at the end of 2018, and now, the ECB will keep its balance sheet at about 4.7 trillion Euros indefinitely (for now) by reinvesting the amounts raised from the bonds coming due.

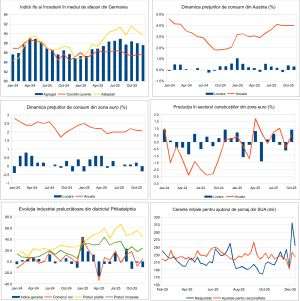

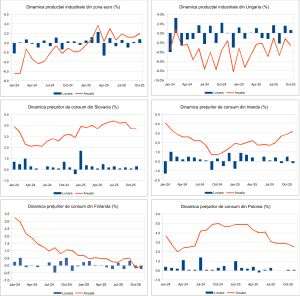

Unfortunately, the Eurozone cannot "dodge" the recent downward trend, especially when its biggest economy, Germany, depends on the ability of its foreign partners to buy its products.

And this trend is "formed" by the policy of the major central banks, especially that of the Federal Reserve. According to the latest data, the combined balance sheet of the European Central Bank, Federal Reserve, of the Bank of Japan and People's Bank of China, has seen a negative dynamic in Q4 2018, equivalent to a withdrawal of the liquidity from the markets, which led to the accented decline of the international exchanges.

From an annual increase of 2.77 trillion dollars in February 2018, the combined balance sheet of the main central banks has gone to an annual contraction of 173 billion in December 2018, as the evolution has been determined by the negative dynamic of the balance sheet of the Federal Reserve. The data of the Federal Reserve shows that the balance sheet of the American central bank has dropped by another 10 billion in the first half of January 2019.

Amid the significant deterioration of the economic outlook, the Chinese authorities are now trying to "implement" a "camouflaged" quantitative easing program, but the odds of success are almost nil, as the marginal effectiveness of the printing press, regardless of its nature, seems to have already entered a negative territory.

The deterioration of the economic situation is manifesting the most strongly in Europe, where the economic activity indicators reported by Markit Economics have entered negative territory for France and are very close to that level for Germany.

Is the restarting of the printing presses still unlikely, as the recession in Germany has almost become a certainty, amid the dramatic drop in the official growth forecasts of 2019?

Also in front of the commission of the European Parliament, Mario Draghi has expressed his hope that "the economic stimulus measures announced by the Chinese authorities can save the economy of the Eurozone", because "they will reduce the pressure on Eurozone exporters".

How? Easily. The president of the ECB is hoping that the measures announced in Beijing, a more "temperate" equivalent of the printing press, will lead to the massive buying of the products exported by the Eurozone economies, and that will allow the "occupation" of the oversized production capabilities that exist in China and Europe.

Still, the president of the ECB seems to overlook too lightly the escalation of the trade tensions between Europe and China, amid the increasingly aggressive rhetoric concerning the "unfair" competitive advantage of the biggest economy in Asia.

What kind of authorities are those that place the hope for recovery on their main economic competitor, as the pressures are increasing for creating some gigantic companies, (author's note see the case of the Siemens-Alstom merger) by violation the competitive norms in the European treaties?

This is the context, even as there is still talk about a potential normalization of the monetary policy in the Eurozone.

In an interview granted to the Swiss publication Neuen Zurcher Zeitung, Jurgen Stark, the former chief-economist of the ECB, has stated that "Mario Draghi is leaving behind a huge mess" and "that there isn't much room for a normalization of the monetary policy".

"Draghi has not only led the ECB into uncharted territory without a compass and has started a monetary experiment with unknown consequences", but has also contributed to the "transformation of the bank into a powerful and politicized institution, meaning he has made it more vulnerable", said Stark, in whose opinion "the negative interest rates and the quantitative easing are the biggest mistakes of the ECB".

The euphoria of the normalization of the monetary policy seems to have disappeared across the Ocean as well. As Wall Street wrote that "the Federal Reserve officials are taking into consideration the premature halting of quantitative easing", Narayana Kocherlakota, former chairman of the Federal Reserve Bank of Minneapolis, says, in article posted on Bloomberg, that "the Federal Reserve must take into consideration the cut of the interest rates".

Already? But where is the "confidence" "sustainable" economic growth, which should have been "sparked" by the money printing of the central banks?

Jeffrey Snider, CEO of hedge fund Alhambra Investment Partners, has expressed his distrust in the inability of the central bankers to perpetuate the illusion of growth through money printing.

"Magic needs to be credible to work, and the audience needs to be offered something concrete to justify the miracle", Snider writes in a recent analysis.

It would seem now that we have entered that stage where "magicians" can't pull anything out of the hat, and "the central bankers will be surprised and shocked by the evolution of the events, because they have allowed themselves to be fooled by their own tricks, more than anybody else".

Another "heretic", Chris Cole, of Artemis Capital Management, thinks that "Historians will one day note that a Trump, Sanders or Ocasio-Cortes would not have existed without Bernanke, Yellen and Draghi".

Perhaps the same can be said about the situation in Romania, where people like Dragnea, Vâlcov, Teodorovici or Dăncilă would not have existed now without the "eternal" Isărescu of the last three decades.

So let the printing presses restart and let the interest rates drop, for endless welfare!

"Historians will one day note that a Trump, Sanders or Ocasio-Cortes would not have existed without Bernanke, Yellen and Draghi". Chris Cole, Artemis Capital Management